If you have earned income in the United States, you will most likely have to file a tax return with the Internal Revenue Service (IRS) of the United States. If you have to file a tax return, you should make sure you understand how income taxation works in the United States, and get an idea of what you can expect to pay next year for income you earned in 2021.

Before we get to the numbers, let’s talk a little bit about how income tax works in the United States.

Gross Income Is Different Than Taxable Income

Another thing to understand is the difference between gross income and taxable income. Gross income is your total income before any deductions or credits. Think of this as your actual salary before anything is taken out.

For example, if your employer pays you a salary of $60,000, that is your gross income, even though that is likely not what you will get into the bank after things like taxes, retirement plan contributions, health insurance deductions and other things are taken out.

Taxable income is the income your taxes will be calculated on when you are looking at the tax brackets below. Taxable income is essentially your gross income minus any deductions, before taking any credits into account.

This is a good time to take some time to get to understand how deductions and credits work to help determine your taxable income.

Marital Status Matters

The tax brackets are further divided into different groups based on your marital status. There are four statuses you can use to file a tax return.

- Single – This is the only status that can be used if you are not married and do not have any dependents you are taking care of.

- Married Filing Jointly – This is one of two different filing options you can utilize if you are married. For most married couples, this is the status that makes the most sense, as it provides more deductions and lower tax percentages on your total income versus the other option, which is Married Filing Separately.

- Married Filing Separately – This is an option that may be useful to use in unusual and very specific circumstances. If you use a software tool to file taxes, it should be able to determine whether it makes sense to file separately or jointly. If you have any doubt whether this could be an option for you or not, you should consult a professional tax preparer.

- Head of Household – This is an option that can be used if you are single, but you have dependents that live with you more than 50% of the year whose expenses you are responsible for. This option provides a higher standard deduction versus filing as single, and also provides deduction for expenses for your dependents, and is generally going to result in lower taxes than filing as single, if you qualify.

In our article 2021 Tax Brackets For US Tax Filers, we outline the tax brackets for each filing status here so you understand which one is right for your situation.

Different Types of Income Are Taxed Differently

To make things even more complicated, not all income is taxed using the same percentages. Earned income, which is what you make by working for someone (“W-2 Employee”) or by doing work on a contractual or self-employed basis (“1099 Contractor” or “Self Employed”), is taxed in one way.

Capital gains (or losses) are any gains (or losses), which is money you made by selling something of value, such as a piece or real estate or a stock or bond, is taxed another way. Dividends, which are payments that you may have received from company for simply owning (not selling) stocks in that company, are taxed yet another way.

It’s important to make sure you follow instructions in detail when filling out the IRS Form 1040, and use any worksheets in the instruction manual to calculate taxes on dividends and capital gains, which have different calculation methods than regular earned income.

The US Taxes All Global Income

One thing to note is that the tax return for US tax filers will take into account income earned from all worldwide income, not just income earned in the United States. In other words, if you made any income from any other country other than the US, that income must be reported on the US tax return.

It is possible that some or all of this income may not be taxed in the US if you paid taxes to the country in which you earned the income, but it does need to be reported and calculated when filing your tax return. This applies to earned income, interest income, self-employment income, and more.

Also note that there are specific reporting requirements for assets and accounts held in other countries. You may or may not get taxed on these assets, but there are specific foreign asset and account reporting requirements when you file your US tax return. If this applies to you, we recommend you work with a professional tax preparer to make sure you are in compliance.

Progressive Tax System Means Different Income Amounts Are Taxed Differently

Some countries have a flat income tax, which means everyone pays the same rate regardless of how much money they make. The United States, unlike countries with a flat tax system, has what is known as a progressive tax system.

What that means is that the more you make, the higher percentage you will pay on your taxes for additional blocks of income. It is important to understand the different percentages you will be paying at different income levels because it will help you plan how much you can expect to pay in taxes each year.

This will also help you to make sure you are not paying too much or too little in taxes for each paycheck (if you are an employee) or in estimated taxes (if you are self-employed or a contractor).

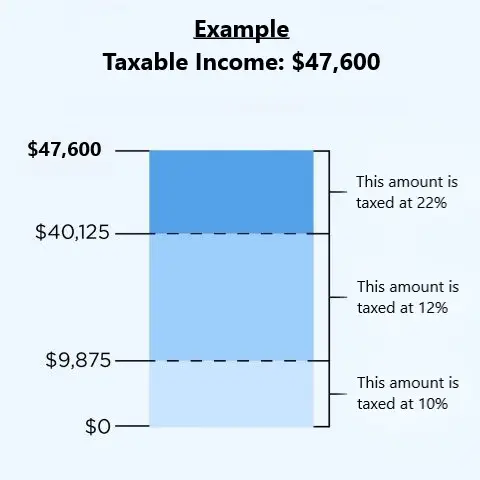

Let’s take an example where your taxable income was $47,600. In order to understand how taxes would be calculated on this amount of income, take a look at the chart below, which gives you a visual example of how progressive taxation works.

As you can see, in our example of taxable income of $47,600, the first $9,875 of income is taxed at a rate of 10%, the next block of income between $9,875 and $40,125 is taxed at 12%, and the remaining $7,475 ($47,600 minus $40,125) is taxed at 22%.

Understanding this concept is very important when you are estimating how much to withhold in taxes on your paycheck or how much to pay in estimated taxes.

To understand the tax calculation in greater detail and also take a look at all of the different tax brackets that are used to calculate taxes, go to our article on 2021 Tax Brackets.

Deductions and Credits Make A Big Difference

As if the different taxation of different types of income is not complicated enough, there are also many deductions and credits that will impact how much you will eventually owe in taxes. Two main deductions are itemized deductions and standard deductions.

Everyone must choose one of these two deductions as an option; you cannot use both. With the changes in the latest tax law from 2017, many more people use the standard deduction.

Itemized deductions include several things you can add together to deduct, but in order for it to make sense to use the itemized deductions instead of the standard deduction, everything you can utilize on itemized deductions combined must be higher than the standard deduction.

We have outlined the standard deductions below so you can decide whether it makes sense to use the standard deduction or the itemized deduction.

In addition to the standard and itemized deductions, there are many other deductions and credits that you may be eligible for. Make sure you follow the instructions for Form 1040 properly in order to get all the deductions or credits you are eligible for.

One thing to know is that deductions lower your taxable income. Credits, on the other hand, reduce the taxes you owe dollar for dollar. Let’s see an example of what this means.

Let’s say that your gross income is the above mentioned $60,000. Assume the only deduction you are eligible for is the standard deduction, which is $12,400 in this example. You would subtract the $12,400 standard deduction from your gross income of $50,000 to give you a taxable income of $47,600.

When you calculate your taxes based on this taxable income, you find that you owe $6,262 total in taxes (more on how this is calculated later).

However, let’s assume you are also eligible for a Lifetime Learning Credit of $2,000. You would then take the total taxes you owe based on your taxable income, which is $6,262, and subtract the credit of $2,000 from the taxes you owe based on your taxable income, to give you the number for the final tax you actually owe, which, in this case, would be $4,262.

To take a look at the standard deductions and all of the different tax brackets for tax year 2021, go to our article on 2021 Tax Brackets.