In this article, we will provide you with an understanding of how taxes are calculated for United States tax filers. We will first talk in general about how to calculate taxes for income earned in the United States.

We will follow that by providing you with the standard deduction options, which are the most common types of deductions used by United States tax filers. Lastly, we will provide you with all of the tax brackets used to calculate earned income in the United States.

If you have not done so already, we strongly encourage you to look at our article that discusses Six Key Rules To Know When Filing A Tax Return. This article covers a lot of the basic things to know before calculating the taxes owed on your tax return.

Progressive Taxation Explained

It’s important to understand that the United States, unlike some countries that have a flat income tax rate for everyone, taxes different amounts of income at different rates. The tax rates get progressively higher with each block of income.

It’s important to understand the different percentages you will be paying at different income levels because it will help you plan how much you can expect to pay in taxes each year. This will also help you to make sure you are not withholding too much or too little in taxes for each paycheck (if you are an employee) or in estimated taxes (if you are self-employed or a contractor).

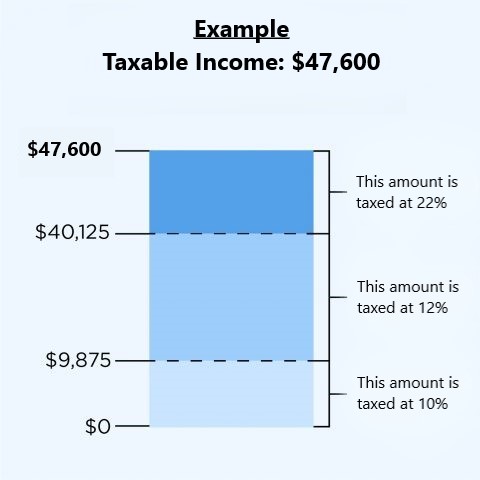

To give you an example of what a progressive tax system means, let’s say your taxable income was $47,600 and you were filing as Single. In order to understand how to calculate taxes on this, you would look at the tax bracket tables at the end of this article and find the taxable income bracket you fall under.

In this example, you would fall within the taxable income bracket of between $40,126 to $85,525, which has a tax rate of 22%. The tax rate for the highest tax bracket you fall under, which, in this case is the 22% tax bracket, is known as the marginal tax rate.

The marginal tax rate is the tax rate for which each dollar of additional income will be taxed at. In other words, if you made $47,601 instead of $47,600, the additional $1 above $47,600 would be taxed at 22% instead of 12%. However, it’s important to understand that you would not pay 22% on all of your income.

You would only pay 22% on income that falls between $40,126 and $85,525, which is your marginal tax bracket. Below is a chart that gives you a visual example of what progressive taxation means in general.

How To Calculate How Much You Owe

In order to understand how to manually calculate your taxes based on this progressive tax system, let’s continue using the example where your taxable income is $47,600.

First, you would start by taking the first $9,875 of your total taxable income, which is the first taxable income tax bracket, and multiply it by 10%, which is the tax rate for that first bracket, which ends giving you $987.50. That is the first number to be used in our final calculation.

Then, look at the next income bracket and you can see that your taxable income of $47,600 is higher than the highest number in the bracket, which is $40,125.

In that case, you would then take the highest number of that bracket, which is $40,125 and subtract the highest number in the lower (10%) bracket, which is $9,875. The value you get when you calculate that subtraction is $30,250.

Take that value and multiply it by the tax rate of that bracket, which is 12%. That number ends up being $3,630. This is the second number for our calculation.

In other words, after accounting for the first $9,875 being taxed at 10%, you then have to account for the next $30,249 of your total taxable income being taxed at 12%. When you add the taxes on the two brackets together, you get $987.50 plus $3,630 for a total of $4,617.50.

However, you still have another several thousand dollars of taxable income to account for, since you still haven’t calculated taxes on the full $47,600 of your total taxable income.

The last step is to calculate the tax in your marginal tax bracket.

In this case, since your taxable income is $47,600, your marginal tax bracket is the 22% bracket for income between $40,126 and $85,525. In order to calculate your final tax number, you would take that $47,600, which is your total taxable income, and subtract the highest number of the bracket below your marginal tax bracket, which, in this case, is $40,125.

That ends in a result totaling $7,475. You would then take that $7,475 total and multiply it by your marginal tax rate for your marginal tax bracket, which, in this case, is 22%. This results in a value of $1,644.50. That is our last data point for our final calculation.

Once you have all individual bracket numbers for taxes owed, you would then add up all three numbers from all three brackets. In this case, that would be $987.50 from the first (10%) bracket, plus $3,630 from the second (12%) bracket, plus the $1,644.50 from your final (marginal) bracket (22%). That results in total tax owed of $6,262. This is before any credits are applied.

Now that you know how the calculation works, we’ve actually made it fairly easy to calculate so you don’t have to make so many calculations. All you have to do is calculate your marginal tax, which is your total taxable income minus the highest number of the bracket below your marginal bracket, multiply the result by your marginal rate, and add the number indicated in the “Tax Owed” section of the table to get the total tax you owe before credits.

Standard Deductions For Tax Year 2021

As we discussed in our Six Key Rules To Know When Filing A Tax Return, there are many deductions and credits that may be taken into account when calculating your taxable income and your final tax amount owed.

Of all the different deductions available, the standard deduction is the most common deduction on most tax returns. Below is a list of the standard deduction available based on your filing status.

In order to get a better understanding of deductions and credits, and also to understand how filing statuses work, take a look at Six Key Rules To Know When Filing A Tax Return.

Marital Status | Standard Deduction |

|---|---|

|

|

|

|

|

|

|

|

Tax Brackets for Tax Year 2021

Below are the tax tables to be used for calculating taxes owed for tax year 2021. Keep in mind that these tables are for earned income, non-qualified dividend income, and short-term capital gains income. These tables should not be used to calculate qualified dividends or long-term capital gains taxes.

In order to understand how filing statuses work, take a look at Six Key Rules To Know When Filing A Tax Return.

Filing Status: Single |

||

Tax rate | Taxable income bracket | Tax owed |

Filing Status: Married Filing Jointly |

||

Tax rate | Taxable income bracket | Tax owed |

Filing Status: Married Filing Separately |

||

Tax rate | Taxable income bracket | Tax owed |

Filing Status: Head of Household |

||

Tax rate | Taxable income bracket | Tax owed |